To empower new and experienced traders by providing access to

cutting-edge algorithmic trading technology to help you experience

above average market growth, while seeing below average market

loss. We achieve this through a disciplined trading strategy that

incorporates effective risk management and a dynamic take profit

system. At The Laser Fund: PAMM, we are committed to driving

financial growth, protecting capital, and achieving sustainable returns

through transparent and disciplined risk management strategies

LASER FUND PAMM is a private copy trader that seeks to capitalize on

the intersection of advanced trading algorithms, data-driven decision-making, and market dynamics.

By leveraging proprietary automation strategies, we aim to achieve consistent gains for our Participants while maintaining a disciplined approach to risk management.

Our PAMM is committed to delivering above-market returns through diversification, robust backtesting, and adaptive algorithms designed for various market conditions.

A PAMM (Percent Allocation Management Module) copy trading system is a platform that enables participants to allocate their

capital into a software that replicates the trading strategies of experienced traders. Essentially, it allows participants to leverage the

expertise of seasoned traders while maintaining full control over their own funds, without requiring active management by the

trader.

Despite its potential, many PAMM copy trader systems encounter failure. The primary reasons for this include:

Lack Of A Defined System

Without a structured approach,

trading decisions become

inconsistent and unplanned.

Improper Risk Parameters

Poor risk management often leads to exposing too much capital to volatile markets.

Over-Leveraging Positions

Without a structured approach,

trading decisions become

inconsistent and unplanned.

Withdrawing Profits

One of the biggest challenges with PAMM copy trading services in the difficulty participant encounter when trying to withdraw their capital, often

due to untrustworthy brokers

TO ADDRESS THESE CHALLENGES

The Laser Fund Pamm

Adheres to stringent company mandates and collaborates exclusively with carefully

selected, reputable brokers.

Why We Choose Regulated

Brokers

A regulated broker is a financial service provider licensed by

recognized regulatory bodies, such as the Financial Conduct

Authority (FCA) in the UK or the Securities and Exchange

Commission (SEC) in the United States. These regulators impose

rigorous requirements on brokers, including regular audits, secure

handling of client funds, and adherence to ethical practices.

At the LASER FUND PAMM, we believe our participants’ cash safety

begins with the brokers we partner with. This is why we partner

exclusively with regulated brokers: institutions that operate under the

strict oversight of financial authorities, ensuring fairness,

transparency, and accountability in every transaction.

Cash Protection

Regulated brokers must separate your

funds from their operational accounts,

meaning your money is safeguarded even

in the unlikely event of financial difficulties.

Market Transparency

With regulated brokers, you benefit from access to fair and transparent markets.

Their pricing, fees, and spreads are clearly disclosed, ensuring no surprises. This lets

you trade with confidence, knowing the playing field is level.

Dispute Resolution

Regulatory bodies offer formal channels

to resolve issues fairly if a dispute arises.

This layer of accountability ensures your

voice is heard and your rights are upheld.

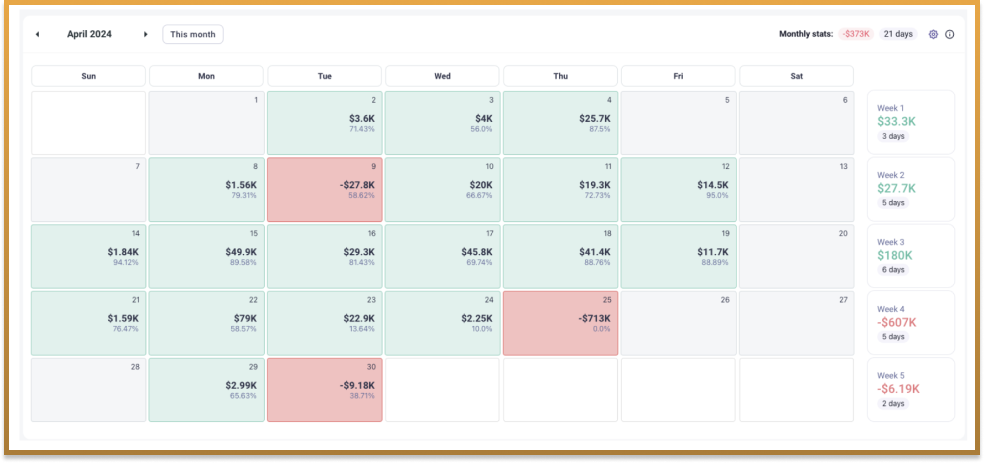

PAMM OVERVIEW: Risk & Profit Projections

Monthly Profit Projections

Target: Achieve a net monthly profit pf

10-30% of the total fund value. that

equals to about 1-5% per day.

Yearly Projections: Sustain

compounded growth over 12 months, with an annualized target of 70-100%

+ return

Monthly Risk Parameters

Maximum Risk Exposure: Limit

monthly drawdown to 15% of fund’s

total capital.

Risk Parameters

Capital Allocation: Allocate no more

than 15% of the fund’s capital at risk at

any given time across all open

positions.

Diversification: Use uncorrelated strategies across assets classes,

including equities forex, and commodities, to mitigate market

specific risks

Drawdown Recovery Plan : Trigger

risk review and adjusted trading if a

15% drawdown is experienced in any trade session. Dynamic risk

adjustment for equity curve

protection in the event for a loss per trading session

As the overall capital within the PAMM account grows, we are scheduled to adjust our risk parameters to lower

levels. This strategic adjustment

ensures enhanced capital preservation while maintaining steady performance, reflecting our commitment to

disciplined risk management and

long-term success

Strategy Enhancement

Adaptive Algorithms: Continuously optimize systems using real-time

data and feedback loops

Stress Testing: Subject all models t extreme market conditions to

ensure robustness and drawdown calculations while backtesting

strategies.

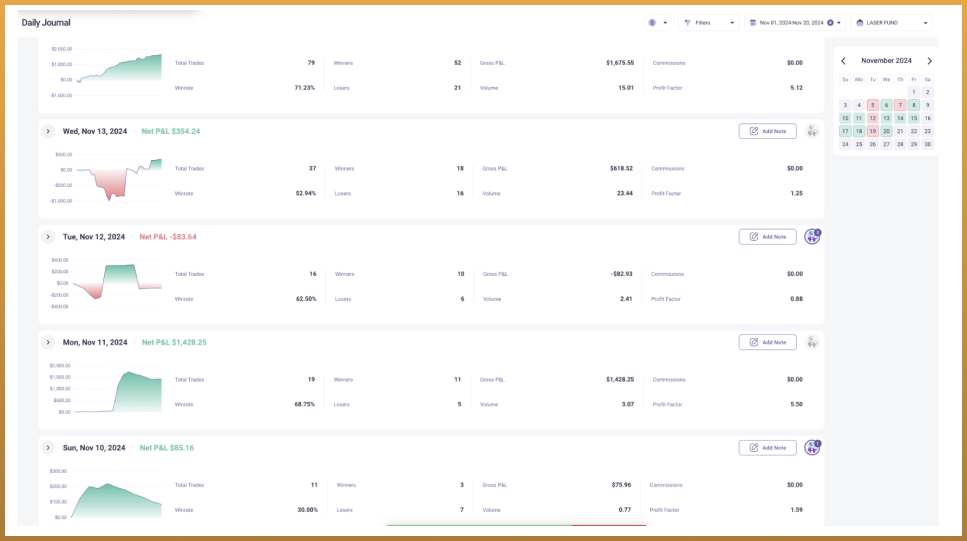

Risk Monitoring: Real-time risk management dashboard for

tracking exposure and compliance

with funds parameters.

The Laser Fund Pamm

Discover how licensed financial professionals are achieving 5-10% monthly

returns passively with this cutting-edge automatic trading algorithm